60 Years after the signing of the Rome Treaty, Europe is not a pretty sight. The UK is leaving after a guest performance of 44 years; populism and Euroscepticism prevail in many Member States; the days of an ‘ever closer union’ seem to be numbered.

‘Restarting the SME credit market in Europe: what role for securitisation and the capital markets?’’

Date

Address

Event Type

Organiser type

Section

Event Location

Event Description

‘Restarting the SME credit market in Europe:

what role for securitisation and the capital markets?’’

Hosted by Othmar Karas, MEP

9 April 2013

6.00pm-8.00pm, followed by a cocktail reception

European Parliament, entrance place Luxembourg, Brussels

Securitisation is a structured finance tool that enables financial institutions to sell cash-generating assets (such as SME loans) on their balance sheets to entities created especially for this purpose. These entities can then issue securities backed by the cash flows of the original asset (asset-backed securities) and sell these to investors. Until 2007, this practice was seen by SME stakeholders as a promising method of financing and risk transfer, with the potential to substantially reduce the cost of capital associated with SME lending and increase the supply of funds.

The financial crisis changed everything. Securitisation earned itself a bad name in policy circles, as the originate-to-distribute model was perceived to be vulnerable to lax lending standards and informational opacity, which led to a loss of liquidity from the wholesale markets. Although failures were largely concentrated in the US sub-prime mortgage and CDO markets, the relatively new practice of SME loan securitisation was also seen as tarnished by association with these sectors, despite European assets performing very well from a credit and secondary market standpoint. This, added to a number of structural challenges, such as the heterogeneous nature of SME loans and the limited liquidity for SME loan-backed securities, made the securitisation of SME loans nearly impossible – and it was difficult enough in the best of times.

Now, as the European economy struggles to find its feet, the sovereign debt crisis and the implementation of CRDIV are forcing banks to ration their capital in a way that is not always supportive of economic recovery in the medium-term. Securitisation of high quality assets is thus regaining attractiveness as a part of a new business model for banks, which could be part of the solution for SMEs’ funding shortfall.

The evidence shows that European securitisations have performed very well, in both credit and pricing terms, in recent years. While of course the lessons of the financial crisis are important, member states need to build on this evidence to ensure that their regulatory frameworks do not hinder the development of an SME loan securitisation market, and prioritise the right tools –including public support- to build a sustainable, liquid market in Europe. In this vein, the European Commission’s Action Plan on access to finance includes a commitment to ‘consider how to promote access to SME bond markets and securitisation,’ while the EIF and the OECD have also called on policymakers to support this move. Much has already been done by the financial industry to rebuild trust in securitisation and engaging in dialogue and awareness-raising efforts to better explain to SMEs and their advisers the benefits of securitisation. The recent industry introduction of the PCS securitisation label, which includes SME loans, is an important part of this process.

Othmar Karas, MEP is therefore happy to invite you to an informed experts’ roundtable jointly organised by UEAPME, AFME (Association for Financial Markets in Europe) and ACCA (the Association of Chartered Certified Accountants), in order to discuss how to ensure a careful revival of SME loan securitisation, building on the recent promising developments in this market.

RSVP by 28th March to cecile.bonino@accaglobal.com (late registration will not be accepted, the security rules of the European Parliament are strict)

If you do not have a permanent pass for the European Parliament, please indicate your

- Full name and first name

- Date of birth

- Nationality

- Passport or ID number

Draft agenda

5.30pm Registration

6.00pm Welcome speech by Othmar Karas, MEP

6.15pm Roundtable moderated by Corien Wortmann-Kool, MEP

- Alessandro Tappi, Head of Guarantees & Securitisation, European Investment Fund

- Richard Hopkin, Managing Director in the Securitisation Division, AFME

- Gerhard Huemer, Director Economy Policy, UEAPME

- Emmanouil Schizas, Senior Economic Analyst, ACCA

- Massimo Baldinato, Member of Cabinet of Commission Vice-President Tajani, in charge of Enterprise and Industry

7.25pm Q&As

7.50pm Concluding remarks , Corien Wortmann-Kool, MEP

8.00pm Cocktail reception

Cecile Bonino

Public Affairs and Media Relations Manager-EU

CBI business house

14 rue de la Science

BE-1040 Brussels

Tel:+32 <Tel:+32> (0) 2 286 11 37

Mob: +44 (0) 7809595008

http://www.accaglobal.com <http://www.accaglobal.com>

Related Events

See the highlight video of this event at this link, and read our related story: "

More information & registration page will be online soon.

EurActiv is a Media Partner of this event.

You are cordially invited to attend the official launch of the 'Hearts and Minds for Europe' website. The event will take place on 23 April 2014 at 1.00 pm at the Committee of the Regions, room 51, Jacques Delors building, Rue Belliard 99-102, 1040 Brussels.

The Treaty of Lisbon as well as developing practices have modified the EU decision-making process substantially. As an EU public affairs practioner, these changes have direct repercussions on your day-to-day activities.

Welcome to the DG CONNECT NIPS CONSULTATION CONFERENCE! On behalf of the European Commission’s DG CONNECT, Capgemini, tech4i2 and Deloitte are delighted to invite you to the consultation conference of the on-going study on the readiness of Member States for a common pan-European

The kick-off event and conference of the European Cyber Security Month-ECSM- brings together the public-private stakeholders in Europe. Their examples of cooperation are singled out as good practices, in order to be inspire followers in the entire community.

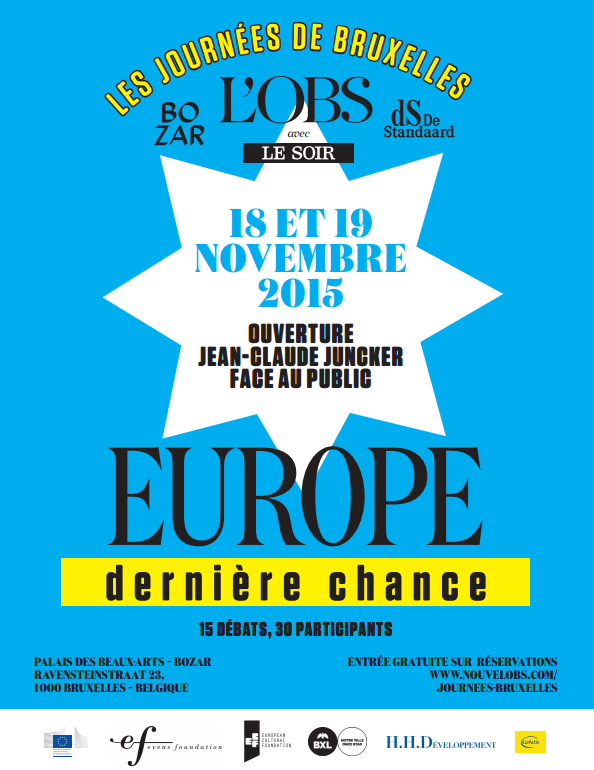

OS Europe... D'année en année, les peuples se détachent de l'idée européenne. D'année en année, le continent reste confiné dans la stagnation économique et le chômage de masse.

MEP Gabi Zimmer, President of the GUE/NGL group and MEP Nikos Chountis invite you to a press conference

Is austerity the only way out of the crisis? Alternative options for Europe.

with Alexis Tsipras, President of Syriza (Greece)

Invitation to a SEAP event

Priorities of the Lithuanian Presidency

Fined for begging? Across Europe, there is a shift towards repressive administrative regimes at local level which often violate fundamental rights of people in vulnerable situations.

MEP Paul Murphy invites you to a press conference

'Ballyhea bondholders' to present petition to the European Parliament

Tomorrow, Tuesday 17/9/2013 at 2.30pm, Press Room ASP5G2 of the European Parliament.